Have Mobile Phone, Will Bank

I have a small confession to make; I am a little behind in the trend of using mobile payment systems such as Apple Pay. Unlike me, many of you have likely started if not fully adopted using your phone to pay for your day-to-day expenses. It is certainly becoming more popular in the US due to convenience. Regardless of whether or not you are following this trend, you probably view these services as being rather new. Well, you might want to hold on to that Starbucks latte that you just bought by using their mobile app, because mobile pay is not all that new. In fact, you may also feel somewhat “behind the times” once you are done reading the following.

My attention was fully captured when I came across a reporting of the 10 year anniversary of M-Pesa. M-Pesa is a mobile money transfer service that was first introduced in Kenya by communication companies Vodafone and Safaricom in March of 2007. Unlike mobile payment options such as Apple Pay, users do not need a bank account, let alone a credit card. In conjunction with the Central Bank of Kenya, the service allows users to make transactions through texts! Money is loaded onto the user’s phone and a text message is sent to the intended recipient to indicate the transaction, which is then shown at the nearest M-Pesa service provider to collect the money. It also offers users access to a savings option with participating banks to store unused money that is loaded and sent.[1] Once I got over my initial surprise from how long mobile phone transactions have been available, what really grabbed me about this information was how this has revolutionized money transfers for Kenyans. M-Pesa has expanded access to banking for people throughout Kenya, even in more remote areas.

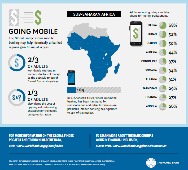

You might be asking yourself, ‘what exactly is the significance of this “expanded access”’? Through my work with the Foundation and as someone who volunteers to teach financial literacy courses, I hear a lot about being “underbanked” (having limited access to banking services) or “unbanked” (having no access to banking services). This is a real problem that many people face which, financially speaking, can be harmful. According to an article from the International Monetary Fund from 2016, over 2 billion people across the globe do not have any type of bank account[2]. Without some of the amenities offered by financial institutions, many of these individuals are forced to use less effective, and yet more expensive means to manage their finances. So, naturally, I found this story about technology helping to abate this issue fascinating and uplifting. In Kenya, M-Pesa helps reduce the number of those who are underbanked or unbanked. It provides a solution for those who fear, mistrust or just live too far away from a financial institution. Since the introduction of mobile phone transaction services, Kenya has become ranked third among countries in sub-Sahara Africa for financial access.[3]

It also offers a means to make payments at any time for those who avoid carrying cash out of fear of being robbed, which is a popular concern[4]. M-Pesa services can be acquired at a majority of corner shops throughout the country which help make it very convenient for its users[5]. It is widely embraced by many Kenyans and used for everyday essentials ranging from sending money to family, paying cabs and paying utility bills. According to the World Bank, Kenya leads the way in the number of financial mobile phone transaction accounts (see Figure 1 above).[6] This has increased growth potential for businesses, especially small or entrepreneurial businesses. For example, individuals selling goods on the side of the road in more remote locations can utilize M-Pesa to pay to restock their product without having to leave their post.[7] According to an MIT study, M-Pesa has reduced poverty by 2% among those who use its services.[8]

It also offers a means to make payments at any time for those who avoid carrying cash out of fear of being robbed, which is a popular concern[4]. M-Pesa services can be acquired at a majority of corner shops throughout the country which help make it very convenient for its users[5]. It is widely embraced by many Kenyans and used for everyday essentials ranging from sending money to family, paying cabs and paying utility bills. According to the World Bank, Kenya leads the way in the number of financial mobile phone transaction accounts (see Figure 1 above).[6] This has increased growth potential for businesses, especially small or entrepreneurial businesses. For example, individuals selling goods on the side of the road in more remote locations can utilize M-Pesa to pay to restock their product without having to leave their post.[7] According to an MIT study, M-Pesa has reduced poverty by 2% among those who use its services.[8]

As a result, Kenya has established itself as a world leader in mobile money transfers.[9] While there are other similar transaction services available, M-Pesa really dominates the Kenyan market and is growing substantially.[10] It now serves 30 million people in 10 countries including India and Romania.[11] If you think that is impressive, wait until you read the following. Last year alone, it processed about 6 billion transactions.[12] A reportedly 529 transactions were made per second at its peak![13] That is massive! It certainly provides a positive perspective that perhaps similar technology can continue to reduce the number of those with limited access to financial institutions (even here in the US), and help people better manage their personal finances.

References

International Monetary Fund. (2016, September 19). Leveraging Financial Technology for the Underbanked [online article] by Rodolfo Maino. Retrieved from https://www.imf.org/en/News/Articles/2016/09/17/NA091916-Leveraging-financial-Technology-for-the-Underbanked

BBC News. (2010, November 22). M-Pesa:Kenya’s Mobile Wallet Revolution [online article] by Fiona Graham. Retrieved from http://www.bbc.com/news/business-11793290

BBC World Service. (2017, March 1). Happy Birthday, M-Pesa [radio broadcast and podcast]. Available at http://www.bbc.co.uk/programmes/p04tnnnv

World Bank. (2015, April 15). Massive Drop in Number of Underbanked, says New Report [online article]. Retrieved from http://www.worldbank.org/en/news/press-release/2015/04/15/massive-drop-in-number-of-unbanked-says-new-report

Images

Figure 1:

World Bank. Who Are The Unbanked? : Uncovering the Financial Inclusion Gap [poster]. Retrieved at http://siteresources.worldbank.org/EXTGLOBALFIN/Resources/8519638-1332259343991/world_bank3_Poster.pdf

[1] “Leveraging Financial Technology for the Underbanked” by Rodolfo Maino, published by Internation Monetary Fund on September 19, 2016

[2] “Leveraging Financial Technology for the Underbanked” by Rodolfo Maino, published by Internation Monetary Fund on September 19, 2016

[3] “Leveraging Financial Technology for the Underbanked” by Rodolfo Maino, published by Internation Monetary Fund on September 19, 2016

[4] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[5] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[6] “Massive Drop in Number of Underbanked, says New Report” published April 15, 2015 by the World Bank

[7] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[8] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[9] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[10] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[11] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[12] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[13] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017