Blogs

Alliant Foundation Blogs

-

Gift Cards: Don't Save Them, Spend Them

By Michael Frerichs | Apr 10, 2018

Odds are that you or someone you know received a gift card during the holiday season.

It is easy to see why. The cards are easy to purchase and (typically) easy to use. They can be the perfect primary gift for that difficult-to-buy-for-friend or a great stocking stuffer for a college student.

However, too many times I have heard stories about a gift card that was saved for a rainy day only to find out that there was no money on the card because too much time had elapsed.

One of the lesser-known roles of the Illinois State Treasurer’s Office involves gift cards. That is why I hear the stories. Here is what you can do to protect yourself:

Know that retail gift cards and bank gift cards are the two most common types of cards. Retail gift cards are only redeemable at a specific retailer or restaurant. Bank gift cards, which carry a payment network such as American Express, MasterCard, or Visa, can be used at any location that accepts that specific brand.

Resist the urge to save the card for a rainy day. Doing so may increase the likelihood that some of the card’s value will be consumed by fees. Instead, use the card and set aside an equal amount of cash for a rainy day.

Remember that while money on a typical bank gift card cannot expire for at least five years, depending upon the circumstances, inactivity fees can begin in as little as 12 months. Therefore, it is possible that inactivity fees could consume the cash value of a bank gift card before the

five year window has expired.Under Illinois’ Consumer Fraud Act, most gift cards sold in Illinois that are usable only at a specific retailer or restaurant are not allowed to incur inactivity fees.

Businesses that close likely will not honor an outstanding gift card.

Treat a gift card like cash. If lost or stolen, report it to law enforcement. Contact the card’s issuer to determine if a replacement card is possible and at what cost.

Today, the state treasurer’s office holds more than $2 billion in unclaimed property. Because our records are updated twice each year, we encourage residents to frequently check our I-Cash database.

Our office never charges a fee to search

for, orreturn, unclaimed property.

Author BioMichael Frerichs was elected Illinois State Treasurer in November 2014. In Illinois, the Treasurer is the state’s Chief Investment Officer and Frerichs is a Certified Public Finance Officer. The office invests money on behalf of the state and local units of government. Mike also believes in providing individuals with the tools so that they can invest in themselves. Frerichs currently serves as Vice Chairman of National Association of State Treasurer’s Legislative Committee as well as Trustee on the Illinois State Board of Investment.

Financial Literacy & Horse Manure

By Dr. Bob Froehlich | Mar 29, 2018

Most investors and students of investing, as they strive to gain financial literacy, often times make the mistake of only focusing on what to read and what to watch. That is only half of the equation. Equally important, but almost never discussed, is what you should not be focusing on and what you should not be paying attention to. True financial literacy can only be achieved when in addition to knowing what to focus on you also know what not to focus on, or worry about. Let me show you what I mean.

THAT’S HORSE MANURE

One of the biggest concerns on investors’ minds today is our weak employment market. The media has many investors believing that one of the main reasons that we have so few jobs is because of all of the advances in technology. In my opinion, that’s horse manure. I’ll explain the horse manure comment later. First, I want to show you that technology isn’t killing all of our jobs. Meaning you should not be worrying about it or focusing on it.

JOBS SHIFT

It’s amazing to think that some people actually believe that technology will eventually eliminate all the jobs and that with no one working, the economy will collapse and so will our stock market. Let me remind you that there’s nothing new about this argument. It’s been around forever, and it’s based on innovation and change. Innovation causes us to change the way we do things, and those changes have an impact on the employment markets. And because technology is our most current innovation, it’s the one most feared and hyped by the media today.

WHERE’S MY BUGGY WHIP?

Let me take a step back and remind you about the evolution of some prior innovations. Can you even imagine the great debate and concern about jobs with the advent of electricity and, even more important, the light bulb? I can hear the discussion now: “What are we going to do with all of the poor candlestick makers who will now be without jobs?” And what do you think happened when the automobile hit the road for the first time? If you were a buggy-whip manufacturer, you suddenly realized that your product wasn’t going to be needed nearly as much in the future as it had been in the past. You don’t need to whip an automobile to get it going. I don’t believe that innovation, and in this case technology, kills jobs. Instead, I think it simply forces a shift in our economy regarding the jobs that aren’t needed and those that are. While it’s easy to focus on the jobs that were made obsolete by technology. What about all of the new jobs that innovations in technology are actually creating? You’ll get a distorted view if you only look at half of the equation.

CAN YOU HEAR ME NOW?

In 1908, based on the explosive growth rates forecasted for the telephone, a Bell Telephone Company engineer predicted that by 1930, every female in the United States between the ages of 17 and 30 would have to become a telephone switchboard operator. Two years later, in 1910, automatic switches were invented. Goodbye, switchboard operators!

I like to think of the switchboard operator, candlestick maker, and the buggy whip manufacturer not as individuals whose jobs were killed, but rather as people whose jobs shifted to fill a new and different need in our economy due to innovation.

THE BIG SHIFT

In the 1800s, more than 80 percent of the jobs in the United States were agriculture-related. Two percent of these jobs were in manufacturing, and zero percent were in the area of technology. With the industrial revolution in the 1900s came an explosion in manufacturing jobs. More than 50 percent of the workforce was in manufacturing jobs, while 40 percent were still in agriculture, and a whopping one percent was in technology.

Fast forward to the 2000s with the technology revolution. Agriculture jobs dropped from a high of 80 percent down to two percent, manufacturing jobs dropped from more than 50 percent to a little more than 10 percent. Meanwhile, technology and service-industry jobs accounted for more than 80 percent.

WHERE ARE THESE TECHNOLOGY JOBS?

You may be asking yourself, just where are all of these technology jobs today? Think Amazon, Groupon, and Google. Amazon didn’t even exist before 1994. Now they have 541,900 employees worldwide with offices, fulfillment centers, customer service centers, and software development centers all across North America, Latin America, Europe, and Asia. Groupon, which only launched in November of 2008, already has more than 10,000 employees. Groupon serves 500 markets in 44 different countries. Finally, Google wasn’t created until 1998. It’s hard to believe that you couldn’t “google” something in 1997. Now, Google has 80,110 employees that run more than one million servers in data centers around the world.

Add to that IBM and its 386,588 employees. Hewlett Packard and its 195,000 employees. Dell Technologies and its 138,000 employees. Microsoft and its 124,000 employees. Apple and its 123,000 employees. Intel and its 106,000 employees. And finally Cisco System and its 73,711 employees.

My point to all of this is that the economy and the stock market aren’t on the brink of disaster because there are no jobs due to technology. What we’re witnessing is simply one more job shift due to innovation. Now let me explain the horse manure comment I made at the beginning of this article.

THE CRISIS OF 1894

Let me frame the issue for you this way. We’re always faced with reports that say, “if trend ‘x’ continues, the result will be

disaster .” While the subject of these stories can be almost anything, the pattern is identical. Today, the subject is all of the jobs being lost to technology. These gloom-and-doom reports take a current trend, extrapolate it into the future, and then use it as the basis for their gloomy prognostications.The problem with all of these gloom-and-doom predictions is that they’re all based on one major, critical assumption that things will go on as they have been. This assumption overlooks one of the basic insights of economics: people respond to incentives, which encourages innovation and change.

Here’s where my horse manure comment comes in. Nineteenth-century cities depended on thousands of horses for their daily functioning. All transport – both goods and people – were drawn by horses. In 1900, London had 11,000 cabs, and every single one was horse-drawn. London also had several thousand buses, each of which required 12 horses to draw them, or a total of 50,000 more horses. This doesn’t even take into account the countless horse-drawn carts working all day long to deliver goods needed by what was, at the time, the largest city in the world. The problem was that all of these horses produced a large amount of manure. On average, a horse produces between 15 and 35 pounds of manure each day. Thus, the streets of nineteenth-century cities were covered with horse manure.

In 1894, a writer for The Times in London estimated that in 50 years, every street in London would be buried under nine feet of manure. That’s not all. Because all of these horses had to be

stabled , they’d take up even larger areas of increasingly valuable land. And, as the number of horses continued to grow, evenmore land would have to be devoted to producing hay for horses rather than food for people. It clearly seemed that the world was doomed!Of course, the world wasn't buried in horse manure. The great crisis vanished when millions of horses were replaced by motor vehicles. This was possible because of innovation.

The next time someone tells you not to invest because the world is going to end because technology is killing all of our jobs, do me a favor and tell them I said, “horse manure,” and then give them a copy of this article.

Author Bio

Renowned former Wall Street executive,

board member, thought leader, best-selling authorand TV personality.Dr. Bob is an expert on global financial markets, global economies, currencies

and global demographic trends. He has chaired investment strategy committees for multiple global asset management organizations. Dr. Bob was named to three different All American Institutional Research Teams. This expertise has gained him international acclaim where he has traveled and has provided investment and financial advice and has delivered a keynote speech on investing in 107 different countries, as well as having six investment books published and translated into 10 different languages. Dr. Bob has the rare distinction of a distinguished professional career combining experience in both the public and private sectors. Finally, his financial services industry knowledge regarding retail investors' behavior and motivation is unmatched. This unique insight and perspective were developed by visiting over 5,000 retail brokerage offices and having met with over 100,000 financial advisors during his Wall Street career.

Since his retirement from Wall Street, Dr. Bob has begun a new chapter in his professional career by building a portfolio of boards spanning private, public, mutual fund and not-for-profit companies. The list currently includes; FC GLOBAL REALTY, INC., FIRST CAPITAL INVESTMENT CORPORATION, GALEN ROBOTICS, INC., HIGHLAND CAPITAL MUTUAL FUNDS, NEXPOINT CAPITAL, INC., KANE COUNTY COUGARS BASEBALL CLUB, AMERICAN SPORTS ENTERPRISE, INC., KC CONCESSIONS, INC., KANE COUNTY COUGARS FOUNDATION, INC., and THE MIDWEST LEAGUE OF PROFESSIONAL BASEBALL CLUBS, INC.Splurge or save: 6 critical questions to ask before you buy

By Megan Nye | Jun 07, 2017

You’re drooling over the idea of a tropical vacation. You’re weighing options for your kid’s education. Maybe you just hate everything in your closet.

Before you buy, figure out whether it’s time to splurge or save with these six questions.

- What’s it worth to you?

What value will you receive from the item or experience you want to purchase?

Does spending mean you’ll have increased safety? Greater peace of mind? Fewer repairs down the road? Or are you paying more than something is worth to you?

Say you’re buying a home. One will cost you $100k, while another will set you back $300k. Ask yourself this question: does the pricier home offer at least an extra $200k in benefit? That might translate to much-needed living space, access to great school districts, proximity to family, or other qualities that are important to you.

- What’s the opportunity cost?

In determining what your potential purchase is worth to you, it’s critical that you look at what you’re giving up to buy it. Your decision to spend or splurge determines how much money you’ll have available for your other priorities.

Do you want to give your kid one expensive birthday gift or four frugal presents? Will you shell out for expensive private schooling if it means years of belt tightening and student loan debt?

- Is buying your best option?

It’s time to think outside the box.

Want to pick up some music, DVDs, or video games? Instead of heading to the mall, check the selection at your local library. Borrow new-to-you entertainment and educational materials.

Want to try out a big-ticket item before you buy? Or are you hoping to use something pricey for just a short time? Consider renting. Get temporary access to formal wear, cars, boats, vacation homes, musical instruments, and more without paying full price.

- Should you buy new or used?

If you always buy brand new, you’re throwing away money. At the same time, consistently choosing second-hand goods can lead to bad deals and even health and safety issues. Inform yourself before you purchase.

Avoid used items that can breed bacteria – mattresses, upholstered furniture, and helmets. Steer clear of borrowed baby gear like car seats and cribs, which may not meet current safety standards.

Buying used, however, is a great tactic for saving on the latest gadgets, cars, dishware, wood furniture, and even pets!

- Have you found the best deal?

Ready to part with your money? Check that you’re not overspending.

Before heading to your favorite online or brick-and-mortar retailer, do some comparison shopping. Look at competitor prices, as well as the availability of print coupons, coupon codes, and discounts from organizations to which you belong.

Here are a few little-known savings secrets:

- Check prices from Amazon’s individual sellers instead of just buying at the advertised price.

- Try eBay, not just for secondhand stuff, but also for steep discounts on brand new items.

- Visit Raise.com or Gift Card Granny to pay less than face value for gift cards.

- Finally, can you afford it?

It’s time to take a peek inside your wallet.

Will splurging eat into your ability to pay your bills? Build your emergency fund? Save for retirement? If it does, you might need to find a thrifty alternative or put off your purchase.

On the other hand, if you’ve got the money, now might be the perfect time to spend!

It’s time to stop worrying about your spending decisions. The next time you’re ready to make a purchase, run down this easy checklist. You’ll feel confident that you’re making smart money choices for you and your family.

Author Bio

Megan Nye is a freelance writer who crafts personal finance and lifestyle content for businesses, blogs, and publications. Her clients include The Huffington Post, The Penny Hoarder, The Dollar Stretcher, MindShift.money, Vibrant Life, Dealspotr, ChimpChange, and Money Saving Mom.

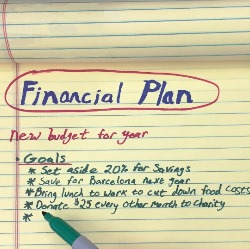

What is Financial Planning? A Step-By-Step Guide for Beginners

By Megan Nye | May 22, 2017What is financial planning?

Simply put, financial planning is the process of creating and following a conscious strategy for your money.

Financial planning means making sure you have the resources to meet your needs while pursuing your goals. You align your money decisions with your customized financial blueprint to make those goals a reality.

If that approach to money sounds incredible but you don’t know where to get started, you’re in the right place. Transform yourself into a pro by working through these four key steps.

Step 1: Know where you’re starting.

It’s impossible to devise a plan for your future if you don’t clearly understand exactly where you stand today.

Getting a clear picture of your money is more than worth the effort it takes to sift through your financial documents. So set aside some time and write down the details of all of your assets and liabilities:

Assets

- Income: Include your paycheck, bonuses, tips, account interest, investment dividends, cash-back rewards, and every other means by which you get money.

- Accounts: Look at the balances of your savings, checking, investment, retirement and pre-tax spending (FSA, HSA, etc.) accounts.

- Property: Consider the value of all big-ticket items you own, even if you’re currently working to pay them off. Examples include jewelry, antiques, your home and your car.

- Everything else: Do you own a business? Possess savings bonds? Have a cash value on your life insurance policy? Include all of those.

- Liabilities

- Loans: List mortgages, car loans or leases, student loans, home equity loans, personal loans, etc.

- Consumer Debt: Write down the outstanding balance of every credit card you have.

Step 2: Define where you want to go.

Getting clear on your financial picture can be an eye-opening experience. No matter where you are now though, you can create successful short-term and long-term financial goals for your family.

Be specific about what you want.

Some common money goals include paying off debt, retiring by 65, saving up enough cash to replace an old car and taking a summer vacation.

Write down a full list of everything you want your money to do for you, split up into short-term and long-term goals.

Step 3: Map out your plan.

Now that you’ve made a list of your goals, it’s time to sketch out the route you’ll take to reach them.

Ask yourself important questions like these...

- Which goals should I tackle first?

- Where will the necessary money come from? (How will you increase your income and/or decrease your spending to make it happen?)

- How much money can I put toward each goal?

- At that rate of saving, when do I plan to reach my goal? Remember to plan for the unexpected.Write down a budget. It’s an excellent way to see your current financial picture at a glance and make sure that you’re allocating enough money toward each of your priorities.

- Don’t let a lay-off or unexpected medical bill derail your entire strategy. Build a time cushion into your financial plan. And protect yourself financially from disaster with an emergency fund and insurance coverages for health, property, life and disability.

- Create checkpoints for your progress as you work toward your goal. Maybe your mini-goal along the path to being debt-free in three years will be paying off your highest-interest credit card in six months.

Step 4: Execute.

You’ve got your financial plan, so get started!

Don’t be discouraged if you run into problems along the way. Creating a strategy that works for you involves trial and error. Life circumstances change, and you’ll need to adjust your plan accordingly.

Make a date with yourself to review your finances at least once a month, and tweak your plan as needed.

Keep focused on your big financial goals as you work on making smart money choices every day.

Author Bio

Megan Nye is a freelance writer who crafts personal finance and lifestyle content for businesses, blogs, and publications. Her clients include The Huffington Post, The Penny Hoarder, The Dollar Stretcher, MindShift.money, Vibrant Life, Dealspotr, ChimpChange, and Money Saving Mom.

How to Conquer Common Money Traps at Every Age

By Megan Nye | May 22, 2017

First, the bad news: It doesn’t matter how old you are.

There’s always a new way for you to make big money mistakes. To mess up the financial balance you’ve worked so hard to create in your life.

Don’t worry – there’s good news too: With a little knowledge and a bit of planning, you can demolish the financial obstacles that stand in your way.

Your 20s: Living large

If you’re fresh out of college and you’ve landed a full-time job, you’ve been dropped into a foreign environment. All of a sudden you probably have ...

- Way more income than you ever earned from a part-time gig.

- Student loan debt that’s due for repayment soon.

- New living expenses as you transition from the dorm to your own place.The solution? Creating good money habits right from the start:

- It’s a lot of financial change – and responsibility – all at once. And it can make you freak out or stumble your way into bad money decisions. Mistakes like overspending, credit card debt, and student loan default are common.

- Learn money skills right away and become financially literate.

- Get organized to stay on top of your income sources, your bills, your debt, and your long-term goals.

- Live below your means, putting the excess toward savings, debt repayment, and even retirement. Compound interest will make your money grow like crazy by the time you exit the workforce!

Your 30s: Taking on too much

Once you enter your 30s, you’re definitely adulting.

Thirty-somethings buy houses, have kids, and purchase new cars. (Hello, minivan.) And you may find yourself in over your head with . . .

- A burdensome mortgage,

- Hefty car payments,

- And pricey childcare and education costs. The solution? Pursuing your financial priorities:

- Once you exit your 20s, it’s easy to start drowning in new, huge expenses . . . and maybe even loads of debt.

- Make a list of your competing financial goals – retirement by 65, educational funding for the kids, a new patio, etc.

- Make a budget, differentiating between fixed costs (like your monthly mortgage payment) and variable expenses (like food & vacation spending).

- Use (or tweak) your budget to create a realistic timeline for achieving your big financial goals.

- Make sure your family is protected along the way with an emergency fund, life insurance, disability insurance, and more.

Your 40s: Juggling big money goals

It’s starting to get real.

If you plan to retire in your 60s, half of your working years are already behind you. And if you plan on helping your kids pay for college, you’re rapidly running out of time before dorm move-in day.

A huge mistake that well-meaning parents make is over-sacrificing for that tuition bill. It’s wildly tempting to pull that money from . . .

- Your retirement accounts,

- The home equity you’ve built up,

- And your credit cards.

- The solution? Getting realistic about what you can contribute to your kids’ college funds:

- Make sure you’re funding your retirement accounts enough to hit your target numbers. (Remember: You can get a college loan but not a retirement loan!)

- Explore ways to save money on that college bill, like attending a less expensive school, sharing living expenses with a roommate, and seeking out scholarships. Every little bit helps.

- Don’t be afraid of college loans. More than two-thirds of U.S. students leaving four-year colleges carry student loan debt. Help your kids to make good decisions about loans so they don’t take on too much debt or face unrealistic repayment terms after graduation.

Your 50s & 60s: Not gearing up for your golden years

Retirement is looming around the corner, but you may be floundering.

As you think about transitioning to the next phase of your life, you’re faced with major decisions about ...

- When you’re officially throwing your briefcase into storage.

- Exactly how much money you need to retire.

- What your retirement will look like personally and financially.The solution? Cover all of your bases before that big day:

- Here’s what you don’t want to do: Eat your retirement party cake before working out all of your financials.

- Create a detailed plan for your retirement lifestyle. Talk with your financial advisor or use an online calculator to figure out how exactly how much money you’ll need to have saved.

- Use your age to your benefit. Now’s the time to take advantage of catch-up contributions and, yes, senior discounts on your favorite products and services.

- Get your affairs in order now. Update your will, discuss approaches to tax savings with an accountant, and look into the costs of long-term care insurance.

- Make it last. Don’t take unnecessary risks by making your retirement portfolio too stock-heavy. And don’t start tapping in to your accounts or your Social Security money too early.

Along life’s journey, you’ll encounter an ever-changing landscape of financial needs and opportunities. But you can navigate your way successfully with a proactive plan for your money!

Author Bio

Megan Nye is a freelance writer who crafts personal finance and lifestyle content for businesses, blogs, and publications. Her clients include The Huffington Post, The Penny Hoarder, The Dollar Stretcher, MindShift.money, Vibrant Life, Dealspotr, ChimpChange, and Money Saving Mom.

Frank Abagnale's Check List for Protecting your Credit

By Frank Abagnale | Jun 12, 2017.jpg)

Frank Abagnale is a highly repected authority on forgery, embezzelment and secure douments. For over 40 years he has worked with, advised, and consulted with hundreds of financial institutions, corporations and government agencies around the world. His life story influced the film and Broadway production, Catch Me If You Can. Below is an excerpt from his publication "Frank Abagnale's Tips for Protecting your Credit". To read the entire publication, you can visit his website http://www.abagnale.com/index2.asp.

Most people don’t think they’ll ever become a victim of identity theft or credit fraud. They feel it will always happen to “the other guy”… that their credit and identity are immune to theft. Unfortunately, identity thieves don’t have a preference for the age, race, sex, income or geographic location of their victims. If your personal information somehow makes itself available to a criminal, it’s up for grabs and you might be the last to know it’s been stolen. So let’s talk about you for a minute…or two. Have you taken steps to protect your identity? Do you place your personal information in potentially compromising positions? Are you sure that your identity and credit have not been compromised? To better answer these questions, we’ve designed a short Risk Assessment to help you determine if you might be at risk of becoming an identity theft victim. It’s very important to the safety and security of your name and your credit.

Frank Abagnale's Check List For Protecting Your Credit

By Frank Abagnale | May 18, 2017-1.jpg)

Frank Abagnale is a highly repected authority on forgery, embezzelment and secure douments. For over 40 years he has worked with, advised, and consulted with hundreds of financial institutions, corporations and government agencies around the world. His life story influced the film and Broadway production, Catch Me If You Can. Below is an excerpt from his publication "Frank Abagnale's Tips for Protecting your Credit". To read the entire publication, you can visit his website http://www.abagnale.com/index2.asp.

Most people don’t think they’ll ever become a victim of identity theft or credit fraud. They feel it will always happen to “the other guy”… that their credit and identity are immune to theft. Unfortunately, identity thieves don’t have a preference for the age, race, sex, income or geographic location of their victims. If your personal information somehow makes itself available to a criminal, it’s up for grabs and you might be the last to know it’s been stolen. So let’s talk about you for a minute…or two. Have you taken steps to protect your identity? Do you place your personal information in potentially compromising positions? Are you sure that your identity and credit have not been compromised? To better answer these questions, we’ve designed a short Risk Assessment to help you determine if you might be at risk of becoming an identity theft victim. It’s very important to the safety and security of your name and your credit.

Have Mobile Phone, Will Bank

By Samantha Heberton | May 26, 2017

I have a small confession to make; I am a little behind in the trend of using mobile payment systems such as Apple Pay. Unlike me, many of you have likely started if not fully adopted using your phone to pay for your day-to-day expenses. It is certainly becoming more popular in the US due to convenience. Regardless of whether or not you are following this trend, you probably view these services as being rather new. Well, you might want to hold on to that Starbucks latte that you just bought by using their mobile app, because mobile pay is not all that new. In fact, you may also feel somewhat “behind the times” once you are done reading the following.

My attention was fully captured when I came across a reporting of the 10 year anniversary of M-Pesa. M-Pesa is a mobile money transfer service that was first introduced in Kenya by communication companies Vodafone and Safaricom in March of 2007. Unlike mobile payment options such as Apple Pay, users do not need a bank account, let alone a credit card. In conjunction with the Central Bank of Kenya, the service allows users to make transactions through texts! Money is loaded onto the user’s phone and a text message is sent to the intended recipient to indicate the transaction, which is then shown at the nearest M-Pesa service provider to collect the money. It also offers users access to a savings option with participating banks to store unused money that is loaded and sent.[1] Once I got over my initial surprise from how long mobile phone transactions have been available, what really grabbed me about this information was how this has revolutionized money transfers for Kenyans. M-Pesa has expanded access to banking for people throughout Kenya, even in more remote areas.

You might be asking yourself, ‘what exactly is the significance of this “expanded access”’? Through my work with the Foundation and as someone who volunteers to teach financial literacy courses, I hear a lot about being “underbanked” (having limited access to banking services) or “unbanked” (having no access to banking services). This is a real problem that many people face which, financially speaking, can be harmful. According to an article from the International Monetary Fund from 2016, over 2 billion people across the globe do not have any type of bank account[2]. Without some of the amenities offered by financial institutions, many of these individuals are forced to use less effective, and yet more expensive means to manage their finances. So, naturally, I found this story about technology helping to abate this issue fascinating and uplifting. In Kenya, M-Pesa helps reduce the number of those who are underbanked or unbanked. It provides a solution for those who fear, mistrust or just live too far away from a financial institution. Since the introduction of mobile phone transaction services, Kenya has become ranked third among countries in sub-Sahara Africa for financial access.[3]

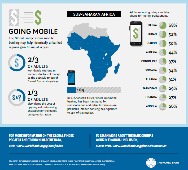

It also offers a means to make payments at any time for those who avoid carrying cash out of fear of being robbed, which is a popular concern[4]. M-Pesa services can be acquired at a majority of corner shops throughout the country which help make it very convenient for its users[5]. It is widely embraced by many Kenyans and used for everyday essentials ranging from sending money to family, paying cabs and paying utility bills. According to the World Bank, Kenya leads the way in the number of financial mobile phone transaction accounts (see Figure 1 above).[6] This has increased growth potential for businesses, especially small or entrepreneurial businesses. For example, individuals selling goods on the side of the road in more remote locations can utilize M-Pesa to pay to restock their product without having to leave their post.[7] According to an MIT study, M-Pesa has reduced poverty by 2% among those who use its services.[8]

It also offers a means to make payments at any time for those who avoid carrying cash out of fear of being robbed, which is a popular concern[4]. M-Pesa services can be acquired at a majority of corner shops throughout the country which help make it very convenient for its users[5]. It is widely embraced by many Kenyans and used for everyday essentials ranging from sending money to family, paying cabs and paying utility bills. According to the World Bank, Kenya leads the way in the number of financial mobile phone transaction accounts (see Figure 1 above).[6] This has increased growth potential for businesses, especially small or entrepreneurial businesses. For example, individuals selling goods on the side of the road in more remote locations can utilize M-Pesa to pay to restock their product without having to leave their post.[7] According to an MIT study, M-Pesa has reduced poverty by 2% among those who use its services.[8]As a result, Kenya has established itself as a world leader in mobile money transfers.[9] While there are other similar transaction services available, M-Pesa really dominates the Kenyan market and is growing substantially.[10] It now serves 30 million people in 10 countries including India and Romania.[11] If you think that is impressive, wait until you read the following. Last year alone, it processed about 6 billion transactions.[12] A reportedly 529 transactions were made per second at its peak![13] That is massive! It certainly provides a positive perspective that perhaps similar technology can continue to reduce the number of those with limited access to financial institutions (even here in the US), and help people better manage their personal finances.

References

International Monetary Fund. (2016, September 19). Leveraging Financial Technology for the Underbanked [online article] by Rodolfo Maino. Retrieved from https://www.imf.org/en/News/Articles/2016/09/17/NA091916-Leveraging-financial-Technology-for-the-Underbanked

BBC News. (2010, November 22). M-Pesa:Kenya’s Mobile Wallet Revolution [online article] by Fiona Graham. Retrieved from http://www.bbc.com/news/business-11793290

BBC World Service. (2017, March 1). Happy Birthday, M-Pesa [radio broadcast and podcast]. Available at http://www.bbc.co.uk/programmes/p04tnnnv

World Bank. (2015, April 15). Massive Drop in Number of Underbanked, says New Report [online article]. Retrieved from http://www.worldbank.org/en/news/press-release/2015/04/15/massive-drop-in-number-of-unbanked-says-new-report

Images

Figure 1:

World Bank. Who Are The Unbanked? : Uncovering the Financial Inclusion Gap [poster]. Retrieved at http://siteresources.worldbank.org/EXTGLOBALFIN/Resources/8519638-1332259343991/world_bank3_Poster.pdf

[1] “Leveraging Financial Technology for the Underbanked” by Rodolfo Maino, published by Internation Monetary Fund on September 19, 2016

[2] “Leveraging Financial Technology for the Underbanked” by Rodolfo Maino, published by Internation Monetary Fund on September 19, 2016

[3] “Leveraging Financial Technology for the Underbanked” by Rodolfo Maino, published by Internation Monetary Fund on September 19, 2016

[4] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[5] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[6] “Massive Drop in Number of Underbanked, says New Report” published April 15, 2015 by the World Bank

[7] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[8] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[9] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[10] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[11] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[12] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

[13] “Happy Birthday, M-Pesa” broadcast on BBC World Service Radio on March 1, 2017

Time for National Financial Literacy Month

By Samantha Heberton | May 22, 2017

As we all know, April is National Financial Literacy Month...oh, wait, you did not know that already? Well, now you can add it onto the list of things you associate with April alongside: spring; April Fools’ Day; the expression, “April Showers Bring May Flowers”; and (prepare to break out into a cold sweat and watch your anxiety levels rise) filing taxes. April was granted the honor of being National Financial Literacy Month back in 2003. It is the perfect time to take steps toward improving your money management skills and to help support financial literacy education. The fact that you are reading this blog article shows you are already getting a head start.

You are never too old or too young to continue/start learning about financial literacy. There are so many different ways to learn about and teach it. When I was a child, my parents got a Caboodles lock box in which I had to keep my allowance. In order to add or remove money from this box, I had to use a fake check book to write deposits and checks, and record all my “transactions”. Now, there is the option of an actual youth savings account, which many financial institutions offer. These provide children with a hands-on learn-through-experience approach. Nevertheless, my parents’ makeshift system did effectively instill in me the value of tracking my income, expenses, and budgeting. I truly believe it is a reason why I understand the importance of financial responsibility. Plus, my purple Caboodles lock box was pretty styling!

There is also a plethora of great resources all within the reach of a Google search that can provide educational tools and information. One website is dedicated entirely to National Financial Literacy Month, to the point that the website itself is actually called Financial Literacy Month. It offers “30 Steps to Financial Wellness” as a basic guide to help you get on top of your personal finances. You can also attend local financial literacy events and programs. Take for example, Money Smart Week, a financial literacy public awareness program launched in 2002 by the Federal Reserve Bank of Chicago. They partner with organizations to help bring Money Smart Week events across the country every year for one week during April. Their 2017 events will take place from April 22nd- April 29th. Visit their website to look up programs near you, including the Alliant Credit Union Foundation’s event (click here for more information). You can check our “Upcoming Events” section on our Homepage for additional details as well.

Not only is April an opportune month to educate yourself about financial literacy; it is an ideal time to consider sharing your financial knowledge with others as well. Parents, guardians and teachers can find lots of great interactive, educational content to help teach their children. The TV show, Biz Kid$ provides children with a good basic understanding of money management, not to mention they happen to be entertaining as well. Check your local PBS station’s listings for broadcasting times; or, you can find Biz Kid$ videos, games and lesson plans online. You can also go to our Kids & Money page for Biz Kid$ video clips and links to various online games, all geared for teaching valuable financial skills. The website Jump$tart offers educational material for children to learn about finances and the economy. Their lesson plans can be used in either the classroom or at home. There are also a great number of volunteer opportunities in which you can give your time to advocate for and teach financial literacy. National programs like Operation HOPE and Junior Achievement are constantly seeking more volunteers to serve as teachers. If you are an organization looking for ways to give back to your community, you too can participate in National Financial Literacy Month. Consider becoming a partner of the aforementioned Money Smart Week to support an event or host your own.

However you decide to learn about, promote or teach financial literacy, you can find something that suits your needs best. All that matters is that you start somewhere and you keep up the good work. From all of us at the Alliant Credit Union Foundation, Happy National Financial Literacy Month everyone!