What is Financial Planning? A Step-By-Step Guide for Beginners

What is financial planning?

Simply put, financial planning is the process of creating and following a conscious strategy for your money.

Financial planning means making sure you have the resources to meet your needs while pursuing your goals. You align your money decisions with your customized financial blueprint to make those goals a reality.

If that approach to money sounds incredible but you don’t know where to get started, you’re in the right place. Transform yourself into a pro by working through these four key steps.

Step 1: Know where you’re starting.

It’s impossible to devise a plan for your future if you don’t clearly understand exactly where you stand today.

Getting a clear picture of your money is more than worth the effort it takes to sift through your financial documents. So set aside some time and write down the details of all of your assets and liabilities:

Assets

- Income: Include your paycheck, bonuses, tips, account interest, investment dividends, cash-back rewards, and every other means by which you get money.

- Accounts: Look at the balances of your savings, checking, investment, retirement and pre-tax spending (FSA, HSA, etc.) accounts.

- Property: Consider the value of all big-ticket items you own, even if you’re currently working to pay them off. Examples include jewelry, antiques, your home and your car.

- Everything else: Do you own a business? Possess savings bonds? Have a cash value on your life insurance policy? Include all of those.

- Liabilities

- Loans: List mortgages, car loans or leases, student loans, home equity loans, personal loans, etc.

- Consumer Debt: Write down the outstanding balance of every credit card you have.

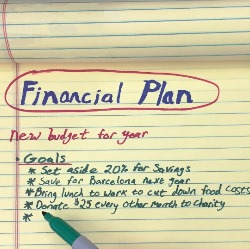

Step 2: Define where you want to go.

Getting clear on your financial picture can be an eye-opening experience. No matter where you are now though, you can create successful short-term and long-term financial goals for your family.

Be specific about what you want.

Some common money goals include paying off debt, retiring by 65, saving up enough cash to replace an old car and taking a summer vacation.

Write down a full list of everything you want your money to do for you, split up into short-term and long-term goals.

Step 3: Map out your plan.

Now that you’ve made a list of your goals, it’s time to sketch out the route you’ll take to reach them.

Ask yourself important questions like these...

- Which goals should I tackle first?

- Where will the necessary money come from? (How will you increase your income and/or decrease your spending to make it happen?)

- How much money can I put toward each goal?

- At that rate of saving, when do I plan to reach my goal? Remember to plan for the unexpected.Write down a budget. It’s an excellent way to see your current financial picture at a glance and make sure that you’re allocating enough money toward each of your priorities.

- Don’t let a lay-off or unexpected medical bill derail your entire strategy. Build a time cushion into your financial plan. And protect yourself financially from disaster with an emergency fund and insurance coverages for health, property, life and disability.

- Create checkpoints for your progress as you work toward your goal. Maybe your mini-goal along the path to being debt-free in three years will be paying off your highest-interest credit card in six months.

Step 4: Execute.

You’ve got your financial plan, so get started!

Don’t be discouraged if you run into problems along the way. Creating a strategy that works for you involves trial and error. Life circumstances change, and you’ll need to adjust your plan accordingly.

Make a date with yourself to review your finances at least once a month, and tweak your plan as needed.

Keep focused on your big financial goals as you work on making smart money choices every day.

Author Bio

Megan Nye is a freelance writer who crafts personal finance and lifestyle content for businesses, blogs, and publications. Her clients include The Huffington Post, The Penny Hoarder, The Dollar Stretcher, MindShift.money, Vibrant Life, Dealspotr, ChimpChange, and Money Saving Mom.